UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

Securities Exchange Act of 1934

Filed by the Registrant | ☒ | |||

Filed by a Party other than the Registrant | ☐ | |||

Check the appropriate box:

☐ | ||

Preliminary Proxy Statement | ||

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

☒ | Definitive Proxy Statement | |

☐ | Definitive Additional Materials | |

☐ | Soliciting Material |

LA JOLLA PHARMACEUTICAL COMPANY

(Name of Registrant as Specified Inin Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ | |||

No fee required. | |||

☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||

(1) | Title of each class of securities to which transaction applies: | ||

(2) | Aggregate number of securities to which transaction applies: | ||

(3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | ||

(4) | Proposed maximum aggregate value of transaction: | ||

(5) | Total fee paid: | ||

☐ | Fee paid previously with preliminary materials. | ||

☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | ||

(1) | Amount Previously Paid: | ||

(2) | Form, Schedule or Registration Statement No.: | ||

(3) | Filing Party: | ||

(4) | Date Filed: | ||

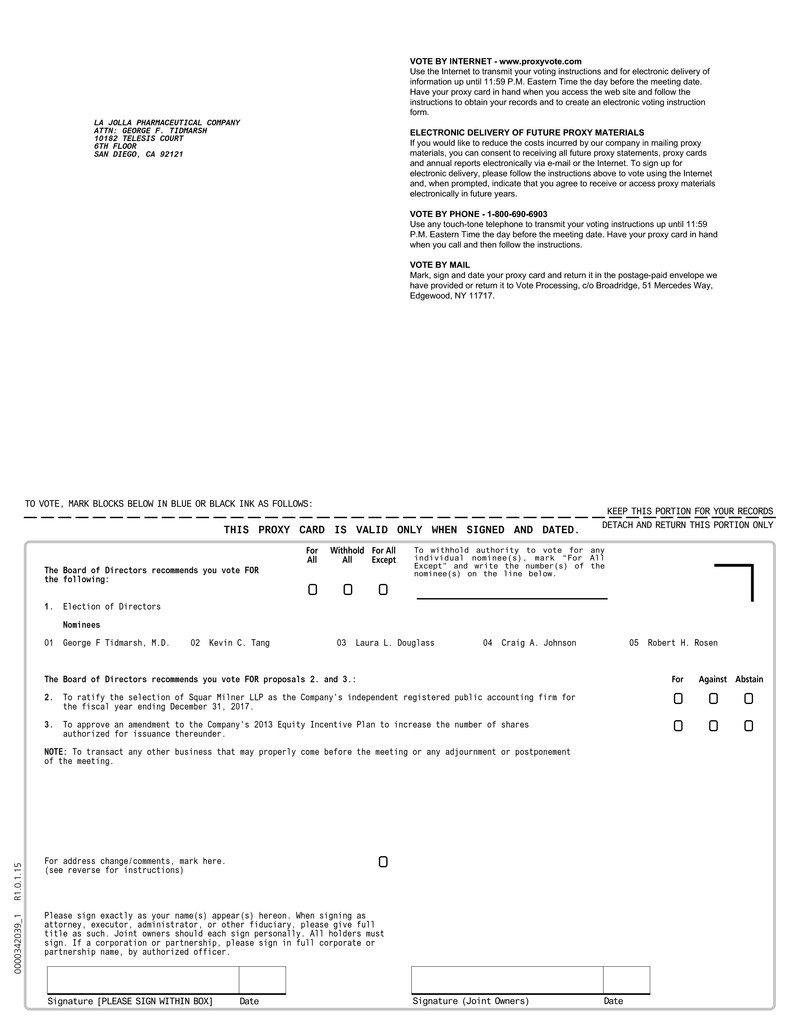

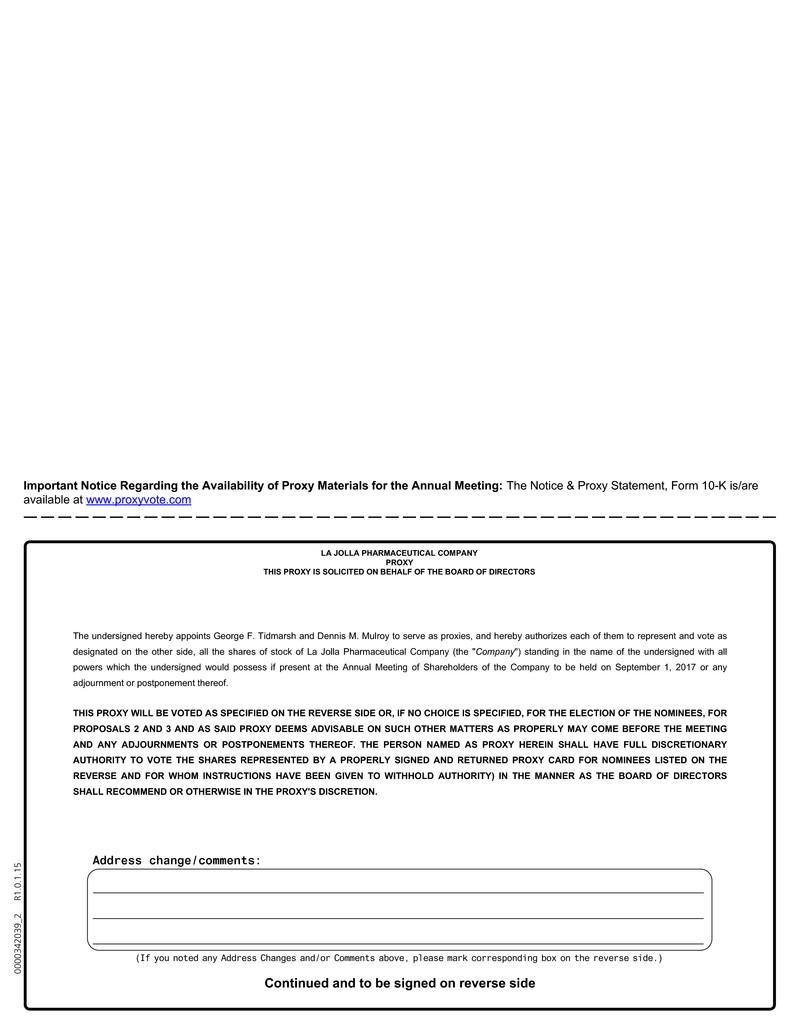

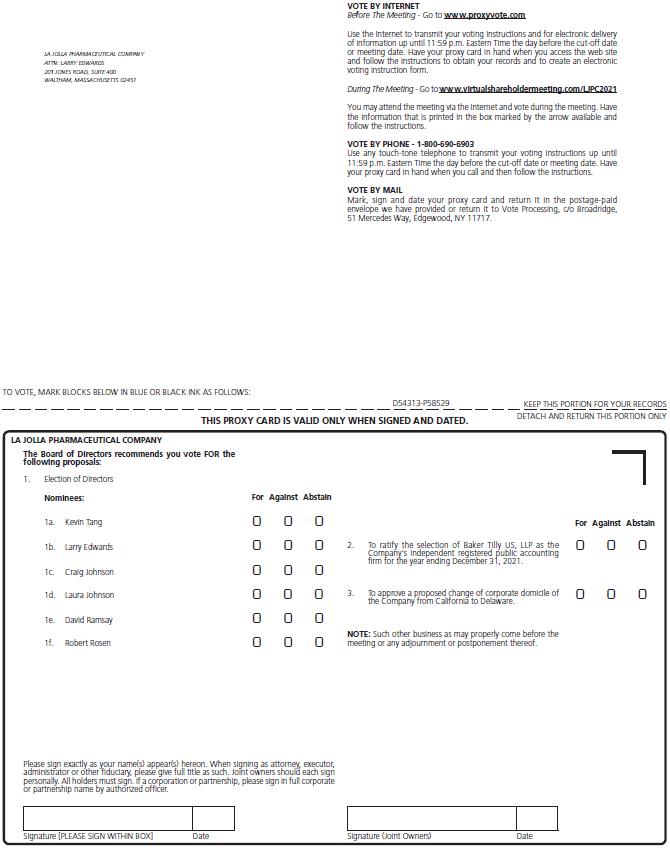

NOTICE OF THE 2021 ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON JULY 21, 2021

To Be Held On September 1, 2017

The 2021 Annual Meeting of Shareholders (the “

1. | To elect |

2. | To ratify the selection of |

3. | To approve |

4. | To transact any other |

The foregoing itemsAnnual Meeting will be a completely virtual meeting of business are more fully describedshareholders. You will not be able to attend the Annual Meeting in person. To participate, vote or submit questions during the proxy statement accompanying this notice.

Only shareholders of record at the close of business on July 17, 2017, the record date of the Annual Meeting, will beJune 1, 2021 are entitled to notice of, and to vote aton, the Annual Meeting or any adjournment or postponement thereof. The Company’s Board of Directors has carefully reviewed and considered the foregoing Proposals and recommends that you vote FOR each nominee and each Proposalproposals described in the proxy statement. It is important that your shares be represented at the Annual Meeting, regardless of the size of your holdings. Accordingly, the Company urges you to vote promptly by completing, dating, signing and returning the enclosed proxy card in the enclosed postage-prepaid envelope, or by voting via telephone or the Internet as instructed in these materials. This will not limit your right to attend or vote at the Annual Meeting. You may revoke your proxy at any time before it has been voted at the meeting.Proxy Statement.

By Order of the Board of Directors, |

/s/ Larry Edwards |

Larry Edwards |

Director, President and Chief Executive Officer |

Waltham, Massachusetts |

June 4, 2021 |

Important Notice Regarding the Availability of Proxy Materials for the 2021 Annual Meeting of Shareholders to Be Held On September 1, 2017

The Proxy Statement and our 2016the Annual Report for the year ended December 31, 2020 are available at www.proxyvote.com

DEFINITIVE PROXY STATEMENT

FOR THE 2021 ANNUAL MEETING OF SHAREHOLDERS

July 21, 2021 at 12:00 p.m. Eastern Time

Q. | |

Why am I receiving these proxy materials? |

A. | |

You are receiving these proxy materials, |

Q. | How can I attend the |

A. | We will be hosting the |

Any shareholder of record as of the close of business on June 1, 2021 (the “Record Date”) may attend the Annual Meeting via live webcast at www.virtualshareholdermeeting.com/LJPC2021. The webcast will begin at 12:00 p.m. Eastern Time on July 21, 2021.

Shareholders may vote and submit questions during the Annual Meeting via live webcast.

Instructions on how to connect to and participate in the Annual Meeting via live webcast, including how to demonstrate proof of share ownership, will be posted at www.virtualshareholdermeeting.com/LJPC2021.

Q. | |

What is the difference between holding shares as a shareholder of record and as a beneficial owner? |

A. | |

Shareholder of |

If your shares of common stock are registered directly in your name with our transfer agent, American Stock Transfer and& Trust Company, LLC, you are considered to be, with respect to those shares of common stock, the shareholder of record, and these proxy materials are being sent directly to you by us. As the shareholder of record, you have the right to vote in person at the Annual Meeting, vote by proxy using the enclosed proxy card or vote by proxy via telephone or the Internet. We have enclosed

Beneficial Owner: Shares of Common Stock Registered in the Name of a proxy card for you to use, which also contains instructions on how to vote via telephoneBroker, Fiduciary or the Internet.

If your shares of common stock are held inby a brokerage accountbroker, fiduciary or by another nominee,custodian, you are considered the beneficial owner of shares of common stock held in street“street name,” and these proxy materials are being forwarded to you from that organization, together with a voting instruction form.broker, fiduciary or custodian. As the beneficial owner of shares of common stock held in “street name,” you have the right to direct your broker, fiduciary or custodian how to vote and are also invited to attend the Annual Meeting. Please noteIf your shares are held in street name and your voting instruction form indicates that since a beneficial owner is not the shareholder of record, you may not vote thesethose shares through www.proxyvote.com, then you may access, participate in, personand vote at the Annual Meeting unless youwith the 16-digit access code indicated on that voting instruction form. Otherwise, shareholders who hold their shares in street name should contact their bank, broker or other nominee (preferably at least 5 days before the Annual Meeting) and obtain a “legal proxy” from the broker, fiduciaryin order to be able to attend, participate in or custodian that holds your shares, giving you the right to vote the shares at the Annual Meeting. Your broker, fiduciary

Q. | Who can vote? |

A. | Only shareholders of record as of the Record Date are entitled to notice of and to vote at the Annual Meeting or any adjournment or postponement thereof. At the close of business on the Record Date, 27,471,378 shares of common stock were issued and outstanding. A list of shareholders entitled to vote will be available for inspection during the Annual Meeting. |

Q. | How many shares must be present to conduct business at the Annual Meeting? |

A. | A majority of the outstanding shares of common stock entitled to vote at the Annual Meeting must be represented either at the Annual Meeting or by proxy to constitute a quorum. A quorum is required to conduct business at the Annual Meeting. |

Q. | What am I voting on? |

A. | The proposals to be voted on at the Annual Meeting are as follows: |

1. | Election of the 6 director nominees named in this Proxy Statement to serve until the 2022 Annual Meeting of Shareholders and until their successors are duly elected and qualified; |

2. | Ratification of the selection of Baker Tilly US, LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2021. |

3. | Change of Corporate Domicile of the Company from California to Delaware. |

Q. | How does the Board recommend that I vote? |

A. | The Board recommends that you vote your shares of common stock “FOR” each director nominee and “FOR” Proposals 2 and 3. |

Q. | What is the vote required to approve each matter? |

A. | Proposal 1: Election of Directors |

In an uncontested election (i.e., an election where the number of director nominees equals the number of director positions up for election), such as the one taking place at the Annual Meeting, directors are elected by a majority of the votes cast, meaning each director nominee must receive a greater number of shares of common stock voted “FOR” his or custodian has enclosedher election than the number of shares of common stock voted “AGAINST” his or providedher election in order to be elected and to serve.

You may vote “FOR,” “AGAINST” or “ABSTAIN” for each of the director nominees. If you “ABSTAIN” from voting instructionswith respect to one or more director nominees, your vote will have no effect on the election of such nominees. In the election of directors, you may vote for no more than 6 director nominees, and you to use in directingmay not cumulate votes. Broker non-votes, if any, will have no effect on this proposal.

Proposal 2: Ratification of Selection of Independent Registered Public Accounting Firm

Ratification of the broker, fiduciaryselection of the Company’s independent registered public accounting firm requires a “FOR” vote from a majority of shares of common stock present at the Annual Meeting, either represented by shareholders present via live webcast or custodian howby proxy, and entitled to vote on the proposal.

You may vote “FOR,” “AGAINST” or “ABSTAIN.” If you “ABSTAIN” from voting with respect to this proposal, your shares.

Proposal 3: Change of Corporate Domicile of the Company from California to Delaware.

The change of corporate domicile of the Company from California to Delaware requires a “FOR” vote from a majority of shares of common stock outstanding as of the Record Date. Additionally, under the California General Corporate Law, the proposal for the change of corporate domicile of the Company from California to Delaware requires approval by holders of a majority of the Company’s outstanding Series C-12 Convertible Preferred Stock. At the close of business on the Record Date, 3,906 shares of Series C-12 Convertible Preferred Stock were issued and outstanding.

You may vote “FOR,” “AGAINST” or “ABSTAIN.” If you “ABSTAIN” from voting with respect to this proposal, your vote will have the same effect as a vote “AGAINST” the proposal. Broker non-votes, if any, will have the same effect as a vote “AGAINST” this proposal.

Q. | What shares can I vote at the Annual Meeting? |

A. | You may vote all shares of common stock owned by you as of the Record Date, including: (i) shares held directly in your name as the shareholder of record; and (ii) shares held for you as the beneficial owner through a broker, fiduciary or custodian. |

Q. | How can I vote my shares without attending the Annual Meeting? |

A. | |

Whether you |

Q. | |

How can I vote my shares |

A. | |

We will be hosting the Annual Meeting via live webcast. You will not be able to attend the Annual Meeting in |

Q. | |

How are votes counted? |

A. | |

Each share of common stock is entitled to one vote on each matter to be voted on at the Annual Meeting. Shareholders will not be |

Q. | What if I sign and return a proxy card or otherwise vote but do not indicate specific choices? |

A. | If you |

Q. | Can I change my vote after I submit my proxy? |

A. | Any proxy given may be revoked by the person giving it at any time before it is voted at the Annual Meeting. If you are a shareholder of record, you may revoke your proxy and |

Q. | |

What is a “broker non-vote”? |

A. | |

A |

Q. | Is my vote confidential? |

A. | Proxy instructions, ballots and voting tabulations that identify individual shareholders are handled in a manner that is designed to protect your voting privacy. Your vote will not be |

Q. | |

What |

A. | |

If you receive more than one set of |

Q. | |

Who is soliciting my vote and who is paying the costs? |

A. | |

Your vote is being solicited on behalf of the Board, and the Company will pay the costs associated with the solicitation of proxies, including preparation, assembly, printing and mailing of this |

Q. | How can I find out the |

A. | |

We |

Q. | |

Whom should I contact if I have questions? |

A. | |

If you have any additional questions about the Annual Meeting or the |

Michael Hearne

Chief Financial Officer

La Jolla Pharmaceutical Company

201 Jones Road, Suite 400

Waltham, Massachusetts, 02451

(617) 715-3598

Our Board of Directors

We currently have five6 members of our Board: Kevin Tang, Larry Edwards, Craig Johnson, Laura Johnson, David Ramsay and Robert Rosen. All members of our Board of Directors (the “

Director Nominees for Director

Each individual listed below areis nominated for election to the Board to serve a one-year term until his or her successor is elected and qualified following the 20182022 Annual Meeting of Shareholders. Our Board recommends that you vote

Name | Age | Position | |||||

Kevin Tang | 54 | ||||||

Director, Chairman of the Board | |||||||

Larry Edwards | 50 | Director, President and Chief Executive Officer | |||||

Craig | 59 | Director | |||||

Laura Johnson(2)(3) | 56 | Director | |||||

David Ramsay(1) | 56 | Director | |||||

Robert | 65 | Director | |||||

(1) | Member of the Audit Committee | ||||||

(2) | Member of the Compensation Committee | ||||||

(3) | Member of the Nominating and Corporate Governance Committee | ||||||

Kevin C. Tang

Larry Edwards has served as a director, of the Company since October 2013. Ms. Douglass has more than 25 years of operating experience in the drug development industry with a particular expertise in clinical trial design and execution. Ms. Douglass is currently the President and Chief Executive Officer of Next Generation Clinical Research, a contract research organization servicing the pharmaceutical industry that she foundedsince 2020. From 2015 to 2020, he served in 1999. Additionally, Ms. Douglass servesvarious positions at Tetraphase Pharmaceuticals, Inc., most recently serving as the President and Chief Executive Officer for Eufaeria Biosciences,Officer. From 2014 to 2015, Mr. Edwards served as Senior Director of Marketing of the Gram-negative Franchise of Cubist Pharmaceuticals, Inc. Ms. Douglass is also a founder(acquired by Merck & Co., Inc.). From 1999 to 2014, he served in various positions at Merck and directorCo., Inc., most recently serving as Global Marketing Director of SB Bancorp, Inc.Clostridium Difficile and Settlers Bank, Inc. She also serves as a director of Agrace HospiceCare. Ms. DouglassNew Infectious Disease Products. Mr. Edwards received a nursingB.S. degree in business and healthcare administration from The University of the State of New York-Albany. Ohio University.The Board has concluded that Ms. DouglassMr. Edwards should serve on our Boardas a director based on her substantial operatinghis experience and expertisebringing innovative treatments that address unmet medical needs to patients in clinical trial management.the acute-care setting.

Craig A. Johnson has served as a director since 2013. He also serves as a director of the Company since October 2013. Mr. Johnson has more than 25 years of experience serving in senior financial management roles and governing corporations, primarily in the biotechnology industry. Mr. Johnson is currentlyHeron Therapeutics, Inc., a director of Mirati Therapeutics, Inc., Heron and a director of Odonate Therapeutics, Inc. and GenomeDxFrom 2015 to 2018, Mr. Johnson served as a director of Decipher Biosciences, Inc. From 2011 to 2014, he served as a director of Adamis Pharmaceuticals Corporation, and, from 2008 through its acquisition by AstraZeneca PLC in 2012, Mr. Johnson served as a director of Ardea Biosciences, Inc. from 2008 until its acquisition by AstraZeneca PLC in 2012, and as a director of Adamis Pharmaceuticals Corporation from 2011 to 2014. From 2011 to 2012, he wasserved as Chief Financial Officer of PURE Bioscience, Inc. From, and, from 2010 to 2011, he wasMr. Johnson served as Senior Vice President and Chief Financial Officer of NovaDel Pharma Inc. Mr. JohnsonFrom 2004 through its acquisition by Raptor Pharmaceuticals Corp. in 2009, he served as Vice President and Chief Financial Officer of TorreyPines Therapeutics, Inc., and, from 2004 until its acquisition by Raptor Pharmaceutical Corp. in 2009 and thento 2010, Mr. Johnson served as Vice President of a wholly-ownedwholly owned subsidiary of Raptor from 2009Pharmaceuticals Corp. From 1994 to 2010. He2004, he held severalvarious positions includingat MitoKor, Inc., most recently serving as Chief Financial Officer and Senior Vice President of Operations, at MitoKor, Inc. from 1994 to 2004. Prior to 1994,Operations. Mr. Johnson held senior financial positions with several early-stage technology companies and also practiced as a Certified Public Accountant with Price Waterhouse. Mr. JohnsonWaterhouse, and he received a B.B.A. degree in accounting from the University of Michigan-Dearborn. The Board has concluded that Mr. Johnson should serve on our Boardas a director based on his substantial experience governingserving as a director of biotechnology companies and his expertise in financial management.

Laura Johnson Robert H. Rosenhas served as a director since 2013. She serves as President and Chief Executive Officer of Next Generation Clinical Research Consulting, Inc., a contract research organization servicing the pharmaceutical industry that she founded in 1999. Additionally, Ms. Johnson serves as the President and Chief Executive Officer of Eufaeria Biosciences, Inc., a biotechnology company that she founded in 2016. Since 2018, she has served as a director of Odonate Therapeutics, Inc.,and since 2020, Ms. Johnson served as a director of Kintara Therapeutics, Inc. She is also a founder, and from 2007 to 2019 served as a director, of Sb Bancorp, Inc. and Settlers Bank, Inc. Ms. Johnson received a nursing degree from the University of the State of New York-Albany. The Board has concluded that Ms. Johnson should serve as a director based on her substantial operating experience.

David Ramsay has served as a director since 2019. He also serves as a director of Exuma Biotech, Inc. and a director of Savara, Inc. From February 2018 through its acquisition by Allergan plc in October 2018, Mr. Ramsay served as Senior Vice President and Chief Financial Officer, and from 2015 to February 2018 served as a director, of Bonti, Inc. From 2003 to 2015, he held various positions at Halozyme Therapeutics, Inc., most recently serving as Chief Financial Officer. From 2000 to 2003, Mr. Ramsay served as Vice President, Chief Financial Officer of Lathian Systems, Inc. From 1998 to 2000, he served as Vice President, Treasurer and Director, Corporate Finance at Valeant Pharmaceuticals International, Inc. (formerly ICN Pharmaceuticals, Inc.). Mr. Ramsay started his career at Deloitte & Touche LLP. Mr. Ramsay received a B.S. in business administration from the University of California, Berkeley, an MBA in finance and strategic management from the Wharton School of the Company since July 2014.University of Pennsylvania and is a Certified Public Accountant (inactive) in the state of California. The Board has concluded that Mr. Rosen has more than 25 years ofRamsay should serve as a director based on his experience serving in leadership positions inas a director of biotechnology and pharmaceutical companies and commercializing innovative pharmaceutical products.his expertise in financial management.

Robert Rosen has served as a director since 2014. Since 2017, he has served as a director of Odonate Therapeutics, Inc. From 2013 to 2019, Mr. Rosen has served as President and as a director, of Heron Therapeutics, Inc. since May 2013. Priorand from 2012 to his appointment as President of Heron Therapeutics, he2013, served as Senior Vice President and Chief Commercial Officer, beginning in October 2012. Priorof Heron Therapeutics, Inc. From 2014 to joining Heron Therapeutics,2015, he served as a director of Conkwest, Inc. (now NantKwest, Inc.). In 2012, Mr. Rosen served as Managing Partner of Scotia Nordic LLC, a life sciences advisory firm. From April 2011 to March 2012, Mr. Rosenhe served as Senior Vice President of Global Commercial Operations at Dendreon Corporation. From 2005 to 2011, heMr. Rosen served as Global Head of Oncology at Bayer HealthCare Pharmaceuticals, where he was responsible for the development of the oncology business unit for regions that included the Americas, Europe, Japan and Asia Pacific. During his tenure at Bayer, Mr. Rosen led the launch of Nexavar® (sorafenib) for the treatment of renal cell carcinoma and hepatocellular carcinoma.Pharmaceuticals. From 2002 to 2005, Mr. Rosen washe served as Vice President of the Oncology Business Unit at Sanofi-Synthèlabo Inc., where he was responsible for the development of Sanofi’s U.S. oncology business and the launch of Eloxatin® (oxaliplatin) for colon cancer. From November 2014 to December 2015, Mr. Rosen served as a director of Conkwest, Inc. (now NantKwest, Inc.). Mr. Rosen received a B.S. degree in pharmacy from Northeastern University. The Board has concluded that Mr. Rosen should serve on our Boardas a director based on his extensive leadership experience in the biotechnology and pharmaceutical industryindustries and expertise in commercializing innovative pharmaceutical products.

Board will be voted for all nominees unless you specify otherwise in your proxy.

The Board of Directors unanimously recommends that youa vote “FOR” each of the director nominees identified above.

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Our BoardAudit Committee has selected Squar MilnerBaker Tilly US, LLP (“

Shareholder ratification of the selection of ourBaker Tilly as the Company’s independent registered public accounting firm is not required to be submitted for shareholder approval. Nonetheless,by law or our Bylaws. However, our Audit Committee is submitting the Board is seeking ratification of its selection of Squar MilnerBaker Tilly to the shareholders for ratification as a matter of good corporate governance.practice. If our shareholders fail to ratify the shareholders do not ratify this selection, the Boardour Audit Committee will reconsider its selection of Squar Milner and will either continue to retain the firm or appoint a new independent registered public accounting firm.selection. Even if the selection is ratified, the Board may,our Audit Committee, in its sole discretion, determine to appointmay direct the selection of a different independent registered public accounting firm at any time during the year if it determinesthey determine that such a change would be in ourthe best interests of the Company and our shareholders’ best interests.

Change in Independent Registered Public Accounting Firm

As previously disclosed in our Current Report on Form 8-K filed with the SEC on November 5, 2020, on November 1, 2020, the audit practice of Squar Milner are expectedLLP (“Squar Milner”), an independent registered public accounting firm, was combined with Baker Tilly in a transaction pursuant to which Squar Milner combined its operations with Baker Tilly, and certain of the professional staff and partners of Squar Milner joined Baker Tilly either as employees or partners of Baker Tilly. On November 1, 2020, Squar Milner resigned as auditors of the Company, and with the approval of the Audit Committee, Baker Tilly was engaged as the Company’s independent registered public accounting firm.

Prior to engaging Baker Tilly, the Company did not consult with Baker Tilly regarding the application of accounting principles to a specific completed or proposed transaction or regarding the type of audit opinions that might be present atrendered by Baker Tilly on the Annual Meeting,Company’s financial statements, and they will be givenBaker Tilly did not provide any written or oral advice that was an opportunity to makeimportant factor considered by the Company in reaching a statement if they desire to do so and are expected to be available to responddecision as to any appropriate questions from shareholders.

The Report of Independent Registered Public Accounting Firm of Squar Milner regarding the Company’s financial statements for the years ended December 31, 2019 and Fees

During the years ended December 31, 2019 and 2018 and during the interim period from January 1, 2020 through November 1, 2020, the date of resignation, there were no disagreements with Squar Milner on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedures, which disagreements, if not resolved to the satisfaction of Squar Milner, would have caused Squar Milner to make reference to such disagreement in its report.

The Company provided Squar Milner with a copy of the foregoing disclosures and requested that Squar Milner furnish the Company with a letter addressed to the SEC stating whether it agrees with the above statements and, if it does not agree, the respects in which it does not agree. A copy of the letter, dated November 5, 2020, was filed as Exhibit 16.1 to the Current Report on Form 8-K filed with the SEC on November 5, 2020.

Independent Registered Public Accounting Firm Fees and Services

The following table presents therepresents aggregate fees for services provided by Baker Tilly and Squar Milner LLP duringfor each of the fiscal years ended December 31, 2016 and 2015:periods below:

| 2020 |

|

| 2019 |

| ||

Audit Fees | $ | 182,730 |

|

| $ | 183,798 |

|

Audit-related Fees |

| 22,216 |

|

|

| 18,684 |

|

Tax Fees |

| - |

|

|

| - |

|

All Other Fees |

| - |

|

|

| - |

|

Total | $ | 204,946 |

|

| $ | 202,482 |

|

| 2016 | 2015 | ||||||

| Audit Fees | $ | 141,068 | $ | 177,656 | |||

| Audit-Related Fees | 10,260 | 31,402 | |||||

| Tax Fees | 13,083 | 7,910 | |||||

| Total | $ | 164,411 | $ | 216,968 | |||

Audit Fees

.Audit-related Fees. Audit-related fees identified under this caption also includeconsist of fees for professional services rendered by Squar Milner for the review of the financial statements included in our quarterly reports on Form 10-Q.

Our Audit Committee approves in advance all services provided by our independent registered public accounting firm. All engagements of our independent registered public accounting firm for 20162020 and 20152019 were pre-approvedapproved by the Audit Committee.

Board of Directors

The Board of Directors unanimously recommends that youa vote “FOR” the ratification of the selection of Squar MilnerBaker Tilly US, LLP as the Company’s independent registered public accounting firm.

PROPOSAL 3: AMENDMENTCHANGE OF CORPORATE

DOMICILE OF THE COMPANY FROM CALIFORNIA TO THE COMPANY’S 2013 EQUITY INCENTIVE PLAN

Introduction and Reason for Change of Corporate Domicile

Following the acquisition of Tetraphase Pharmaceuticals, Inc. by La Jolla Pharmaceutical Company, the majority of the Company’s executive management are based in Massachusetts. As a result, in April 2021, the Company relocated its principal executive offices from San Diego, California to Waltham, Massachusetts. In connection with this relocation, the Board proposes to change the Company’s corporate domicile from California to Delaware, the state in which the majority of U.S. public companies are incorporated, subject to approval by our shareholders (the “Change of Corporate Domicile”). The current total share reserveBoard has structured the Change of Corporate Domicile in a manner that keeps substantially intact the existing material rights of the Company’s shareholders. For purposes of this proposal, the Company as it currently exists as a corporation organized under the Company’slaws of the State of California is referred to as “La Jolla-California” or as “we” or “us,” and the Company after the proposed Change of Corporate Domicile, which will keep the name “La Jolla Pharmaceutical Company,” is referred to as “La Jolla-Delaware.”

Shareholders are urged to read this proposal carefully, including the exhibits attached to this Proxy Statement, before voting. The following discussion summarizes material provisions of the proposed Change of Corporate Domicile, but is subject to and qualified in its entirety by: (i) the Agreement and Plan of Merger to be entered into by La Jolla-California and La Jolla-Delaware (the “Change of Corporate Domicile Agreement”), in substantially the form attached hereto as Appendix A; (ii) the Certificate of Incorporation of La Jolla-Delaware to be effective immediately following the Change of Corporate Domicile (the “Delaware Certificate”), in substantially the form attached hereto as Appendix B; and (iii) the Bylaws of La Jolla-Delaware to be effective immediately following the Change of Corporate Domicile (the “Delaware Bylaws”), in substantially the form attached hereto as Appendix C. Copies of La Jolla-California’s Articles of Incorporation (the “California Articles”) and Bylaws (the “California Bylaws”) are publicly available as exhibits to the reports we have filed with the SEC and also are available for inspection at our principal executive offices. Additionally, we will send copies to shareholders free of charge upon written request to our Secretary at 201 Jones Road, Suite 400, Waltham, Massachusetts 02451.

Mechanics of the Change of Corporate Domicile

The Change of Corporate Domicile would be effectuated pursuant to the terms of a merger agreement providing for us to merge into a newly formed, wholly owned subsidiary of the Company incorporated in the State of Delaware. The Company, as it currently exists as a California corporation, will cease to exist after the merger, and La Jolla-Delaware will be the surviving corporation and will continue to operate our businesses as if it were operated prior to the Change of Corporate Domicile. Following the Change of Corporate Domicile, the existing holders of our common stock and preferred stock will own all of the outstanding shares of La Jolla-Delaware common stock and preferred stock, respectively, and there will be no change in the number of shares owned by or in the percentage ownership of any shareholder as a result of the Change of Corporate Domicile. At the time and date on which the Change of Corporate Domicile becomes effective, if at all (the “Effective Time”), we will be governed by the Delaware Certificate, the Delaware Bylaws and the DGCL.

In the Change of Corporate Domicile, all outstanding equity awards, including stock options to purchase La Jolla-California common stock, that are outstanding under La Jolla-California’s equity incentive plans, including its 2013 Equity Incentive Plan and its 2018 Employee Stock Purchase Plan (the “

Control” under any of the Equity Plans, and therefore the provisions of the Equity Plans that provide for more favorable treatment to holders of awards in such an event will not apply.

Assuming approval of the Change of Corporate Domicile proposal at the Annual Meeting, we currently anticipate that we will effectuate the Change of Corporate Domicile as soon as reasonably practicable thereafter. The Change of Corporate Domicile Agreement provides that the Board may abandon the Change of Corporate Domicile at any time prior to the Effective Time if the Board determines that the Change of Corporate Domicile is inadvisable for any reason. The Change of Corporate Domicile Agreement may be amended at any time prior to the Effective Time, either before or after shareholders have voted to adopt the proposal, subject to applicable law. We will re-solicit shareholder approval of the Change of Corporate Domicile if the terms of the Change of Corporate Domicile Agreement are materially changed.

LA JOLLA-CALIFORNIA SHARE CERTIFICATES AND BOOK-ENTRY POSITIONS WILL AUTOMATICALLY REPRESENT SHARES AND BOOK-ENTRY POSITIONS OF LA JOLLA-DELAWARE UPON THE EFFECTIVENESS OF THE CHANGE OF CORPORATE DOMICILE. SHAREHOLDERS WHO HOLD LA JOLLA-CALIFORNIA SHARE CERTIFICATES WILL NOT BE REQUIRED TO SURRENDER OR EXCHANGE THEIR LA JOLLA-CALIFORNIA SHARE CERTIFICATES SOLELY IN CONNECTION WITH THE CHANGE OF CORPORATE DOMICILE.

No Change to the Business of the Company as a Result of the Change of Corporate Domicile

The Change of Corporate Domicile itself will not result in any change in the business, physical location, management, assets, liabilities or capitalization of the Company, nor will it result in any change in location of our current officers or employees. The consolidated financial condition and results of operations of La Jolla-Delaware immediately after consummation of the Change of Corporate Domicile will be the same as those of La Jolla-California immediately prior to the consummation of the Change of Corporate Domicile. In addition, upon the effectiveness of the Change of Corporate Domicile, the Board of Directors of La Jolla-Delaware will be comprised of the persons who were elected to the Board of Directors of La Jolla-California at the Annual Meeting, and they will continue to serve until the next annual shareholders’ meeting and until their successors are elected. There will be no changes in our executive officers or in their responsibilities. Upon effectiveness of the Change of Corporate Domicile, La Jolla-Delaware will be the successor in interest to La Jolla-California. All of our employee benefit and incentive compensation plans existing immediately prior to the Change of Corporate Domicile, including the Equity Plans, will be continued by La Jolla-Delaware. The registration statements of La Jolla-California on file with the requirementsSEC immediately prior to the Change of Section 422Corporate Domicile will be assumed by La Jolla-Delaware, and with other applicable legal requirements (including applicable stock exchange requirements), Stock issued under awardsthe shares of an acquired companyLa Jolla-Delaware will continue to be listed on Nasdaq.

Preservation of Material Shareholder Rights

The Board recognizes that there are several rights and protections that are converted, replaced, or adjustedafforded to shareholders in connection with the acquisition shall not reduce the number of shares available for AwardsCalifornia Articles and Bylaws and under the Plan.California General Corporation Law (the “CGCL”). Accordingly, the Board has proposed to maintain the existing material rights and protections in the Delaware Certificate and Bylaws, including:

No unequal voting right or dual class structure. All shares of common stock are entitled to one vote per share.

No classified board. All directors stand for election annually.

Majority voting for director elections. In uncontested director elections, directors will be elected by a majority voting standard (in contrast to La Jolla-California’s current standard of plurality voting coupled with a director resignation policy).

Limited supermajority voting provisions. Shareholders can remove directors, approve significant corporate transactions, and amend the Delaware Bylaws and most provisions of the Delaware Certificate by majority vote.

No requirement for “cause” to remove directors. Shareholders can remove directors for any reason at any time.

Written consent. Shareholders can act by written consent subject to certain procedural and informational requirements.

Special meetings. Shareholders holding at least 10% of our common stock can call a special meeting of shareholders.

Although the Delaware Certificate and the Delaware Bylaws contain provisions that are similar to the provisions of the California Articles and the California Bylaws, they also include certain provisions that are different from the provisions contained in the California Articles and the California Bylaws or under the CGCL, as described in more detail below.

Select Comparison between the Charters and Bylaws of La Jolla-California and La Jolla-Delaware

The following table includes aggregated information regarding awards outstanding under our 2013 Plan,compares certain key provisions in the numberArticles of shares available for future awards under our 2013 Plan as of July 1, 2017,Incorporation and the proposed numberBylaws of shares issuable underLa Jolla-California and comparable provisions in the 2013 Plan:

Number of shares | As a percentage of stock outstanding(1) | ||||

| Outstanding stock options | 3,838,115 | 11.41 | % | ||

| Outstanding restricted stock awards and exercised options | 202,893 | 0.60 | % | ||

| Total shares issued or subject to outstanding awards as of July 1, 2017 | 4,041,008 | 12.01 | % | ||

| Total shares available for future awards as of July 1, 2017 | 558,992 | 1.66 | % | ||

| Proposed increase in shares available for future awards | 3,500,000 | 10.41 | % | ||

| Proposed shares available for future awards | 4,058,992 | 12.07 | % | ||

Options Granted | Full-Value Shares Granted | Total Granted | Average Number of Fully Diluted Shares | Annualized Burn Rate | |||||

| 2014 - 2016 | 4,064,000 | 7,000 | 4,071,000 | 24,943,000 | 5.44% | ||||

Provision | La Jolla-California | La Jolla-Delaware | ||

Authorized Shares | 100,000,000 shares of Common Stock, par value $0.0001 per share. | Same. | ||

8,000,000 shares of Preferred Stock, par value $0.0001 per share. | Same. | |||

Vote Required to Approve Merger or Sale of Company | The California Articles do not include super majority voting requirements with respect to the approval of a merger or sale. | Same. | ||

The CGCL provides that a merger or sale of all or substantially all of the assets of the Company requires the approval of a majority of the outstanding shares of each class or series entitled to vote as a class or series thereon. | Same. The Delaware Certificate includes a provision equivalent to the CGCL. | |||

Charter Amendment | The California Articles may generally be amended by action of the Board and the affirmative vote of a majority of the outstanding shares, except that amendments to certain provisions require the approval of 75% of the outstanding shares | Same. | ||

Bylaw Amendments | The California Bylaws may generally be amended by the affirmative vote of a majority of the outstanding shares or by action of the Board. | Same. | ||

Shareholder Action by Written Consent | The California Bylaws permit action by written consent of the shareholders subject to certain limitations. | Same, with the addition of procedural and informational requirements. | ||

Ability of Shareholders to Fill Director Vacancies by Written Consent | Under the CGCL and the California Bylaws, shareholders acting to fill director vacancies by written consent must obtain the unanimous written consent of all shareholders, except that only majority approval by written consent is required for shareholders to fill a vacancy that is unfilled by the Board. | More favorable to shareholders. Under the Delaware Bylaws, shareholders acting to fill director vacancies by written consent do not require the unanimous written consent of all shareholders. Shareholders may fill any director vacancies by written consent of the holders of outstanding shares having not less than the minimum number of votes that would be necessary to authorize or take such action at a meeting at which all shares entitled to vote thereon were present and voted. | ||

Ability of Shareholders to Call Special Meetings | Under the CGCL shareholders can cause the Company to hold a special meeting upon the request of holders of shares entitled to cast not less than 10% of the votes at such meeting. | Same. The Delaware Certificate includes a provision equivalent to the CGCL. | ||

Exclusive Forum Selection Provision | None. | The Delaware Certificate contains an exclusive forum selection provision requiring that, unless we consent in writing to an alternative forum: (i) internal corporate claims, including stockholder derivative lawsuits, be brought in the Delaware Chancery Court; and (ii) causes of actions arising under the Securities Act of 1933 be brought in the U.S. federal district courts. Such provision does not apply to suits brought to enforce any liability or duty created by the Securities Exchange Act of 1934. |

Provision | La Jolla-California | La Jolla-Delaware | ||

Advance Notice Provisions for Nominations and Other Business. | The California Bylaws provide that, in order for a shareholder to make a director nomination or propose business at a shareholder meeting (other than a business proposal included in the Company’s proxy statement pursuant to Rule 14a-8 of the Exchange Act), a written notice containing the name of any person to be nominated by any shareholder for election as a director of the Company or containing any other business sought to be presented at an upcoming shareholders meeting must be received by the Secretary of the Company, generally not less than 90 or more than 120 days prior to the date of such annual meeting (subject to certain exceptions depending on the timing of the meeting). | Same. | ||

The California Bylaws require shareholders to provide certain additional information, and comply with certain additional requirements, to make a director nomination or propose business at a shareholder meeting. | Same. | |||

Change in Number of Directors | The California Bylaws provide that the Board may fix the number of directors within a range between four to seven directors. | Same, except that there is no specified Board size range. | ||

Classified Board | No classified board. Instead, directors are elected annually. | Same. | ||

Filling Vacancies on the Board | The California Bylaws provide that vacancies on the Board not caused by removal may be filled by a majority of the directors then in office, regardless of whether they constitute a quorum, or by a sole remaining director. The shareholders may elect a director at any time to fill any vacancy not filled, or which cannot be filled (e.g., vacancy by removal), by the Board. | Same. | ||

Removal of Directors | Shareholders can remove any director, or the entire Board, with or without cause. | Same. | ||

Under the California Bylaws, unless the entire Board is removed, no director may be removed if the votes cast against removal would be sufficient to elect such director if voted cumulatively at an election at which the same total number of votes were cast and the entire number of directors authorized at the time of his most recent election were then being elected. | More favorable to shareholders. The Delaware Bylaws do not provide for restrictions on, or preconditions to, the removal of directors by shareholders. | |||

Election of Directors | The California Bylaws require that, in an uncontested election, directors offer to tender their resignation in the event that they do not receive a majority of votes cast). The California Articles currently do not allow for cumulative voting. | Similar. In an uncontested election of directors, nominees shall be elected only if they receive a majority of votes cast. Neither the Delaware Certificate nor the Delaware Bylaws provide for cumulative voting. |

Provision | La Jolla-California | La Jolla-Delaware | ||

Indemnification | The California Articles provide for indemnification and advancement of expenses for directors and officers to the fullest extent permissible under applicable law. | Same. | ||

Elimination of Director Personal Liability for Monetary Damages | The California Articles eliminate the liability of directors for monetary damages to the fullest extent permissible under applicable law. | Same. | ||

The CGCL permits a corporation to eliminate the personal liability of directors for monetary damages, except where such liability is based on: • Intentional misconduct or knowing and culpable violation of law; • Acts or omissions that a director believes to be contrary to the best interests of the corporation or its shareholders or that involve the absence of good faith on the part of the director; • Receipt of an improper personal benefit; • Acts or omissions that show reckless disregard for the director’s duty to the corporation or its shareholders, where the director in the ordinary course of performing a director’s duties should be aware of a risk of serious injury to the corporation or its shareholders; • Acts or omissions that constitute an unexcused pattern of inattention that amounts to an abdication of the director’s duty to the corporation and its shareholders; • Transactions between the corporation and a director who has a material financial interest in such transaction; or • Liability for improper distributions, loans or guarantees. | Similar. The DGCL permits a corporation to eliminate the personal liability of directors for monetary damages, except where such liability is based on: • Breaches of the director’s duty of loyalty to the corporation or its shareholders; • Acts or omissions not in good faith or involving intentional misconduct or knowing violations of law; • The payment of unlawful dividends or unlawful stock repurchases or redemption under Section 174 of the DGCL; or • Transactions in which the director derived an improper personal benefit. |

Differences Between the termsCorporation Laws of California and Delaware

The following provides a summary of certain substantive differences between the CGCL and the DGCL, in addition to those discussed above. The following is not intended to be an exhaustive description of all differences between the laws of the 2013 Plan, as proposedtwo states. Accordingly, all statements herein are qualified in their entirety by reference to the respective General Corporation Laws of the states of California and Delaware.

Restrictions on Cash Mergers

Under the CGCL, a merger may not be consummated for cash if the purchaser owns more than 50%, but less than 90%, of the then outstanding shares (the “50/90 Rule”), unless either: (i) all the shareholders consent, which is not practical for a public company; or (ii) the California Department of Business Oversight approves the merger.

The 50/90 Rule may make it more difficult for certain acquirors to make an all cash acquisition of the Company through a tender offer. Specifically, the 50/90 rule encourages an acquiror making an unsolicited tender offer to either tender for less than 50% of the outstanding shares or more than 90% of the outstanding shares. A purchase by such acquiror of less than 50% of the outstanding shares, however, does not allow the acquiror to gain ownership of a majority of the outstanding shares needed to approve a second step merger (for purposes of enabling the acquiror to acquire the remaining shares of the Company) and, therefore, creates risk for such an acquiror that such a favorable vote will not be

obtained. On the other hand, a tender offer conditioned upon receipt of tenders from at least 90% of the outstanding shares also creates risk for the acquiror, because it is likely to be amended, a copyvery difficult to obtain tenders from holders of which is attached hereto as

The DGCL does not have a provision similar to California’s 50/90 Rule.

Restrictions on Statutory Mergers or Company Sales Transactions with Interested Shareholders

Section 1203 of the CGCL, which applies to mergers or corporate acquisition transactions with interested shareholders or their affiliates, makes it a condition to the consummation of a merger or other acquisition transaction with an interested shareholder that an affirmative opinion be obtained in writing as to the Board may delegate: (i) tofairness of the consideration received by the shareholders of the corporation being acquired.

Section 203 of the DGCL makes certain types of unfriendly or hostile corporate takeovers, or other non-board approved transactions involving a corporation and one or more of its members suchsignificant shareholders, more difficult. It does so by generally prohibiting “business combinations,” including mergers, sales and leases of its duties, powersassets, issuances of securities and responsibilitiessimilar transactions, by a corporation or a subsidiary with an “interested stockholder” (generally defined as it may determine;a person or entity who, together with their affiliates and (ii) to such employeesassociates, beneficially owns 15% or other persons as it determines such ministerial tasks as it deems appropriate. In the eventmore of any delegation described in the preceding sentence, the term “Administrator” includesa corporation’s voting stock) within three years after the person or persons so delegatedentity becomes an interested shareholder, unless certain conditions are satisfied.

Delaware corporations may elect to opt out of Section 203 of the DGCL, but La Jolla-Delaware has not done so.

Dividends and Repurchases of Shares

The DGCL is more flexible than the CGCL with respect to the extentpayment of dividends and the implementation of share repurchase programs. The DGCL generally provides that a corporation may redeem or repurchase its shares out of its surplus, or if there is no surplus, out of net profits for the fiscal year in which the dividend is declared and/or for the preceding fiscal year. Surplus is defined as the excess of a corporation’s net assets (i.e., its total assets minus its total liabilities) over a corporation’s statutory capital, which the Board may generally increase or decrease by resolution, subject to a statutory requirement that at a minimum a corporation’s capital must equal the aggregate par value of its issued shares. Moreover, the DGCL permits a board of directors to reduce its capital and transfer such delegation. The Administrator hasamount to its surplus.

Dissolution

Under the authority to: (i) interpretCGCL, the 2013 Plan; (ii) determine eligibility for and grant awards underholders of 50% or more of a corporation’s total voting power may authorize the 2013 Plan; (iii) determine, modifycorporation’s dissolution, with or waivewithout the terms and conditions of any award granted under the 2013 Plan; (iv) prescribe forms, rules and procedures; and (v) otherwise do all things necessary to carry out the purposesapproval of the 2013 Plan.

Possible Negative Consequences of Change of Corporate Domicile

Notwithstanding the belief of the Board in the benefits to our shareholders of the Change of Corporate Domicile, it should be noted that the DGCL has been criticized by some commentators on the grounds that it does not afford minority shareholders the same substantive rights and protections as are conclusiveavailable in certain other states, including California. In addition, franchise taxes payable by the Company in Delaware will be greater than the equivalent or other similar taxes currently payable by the Company in

California. The Board of Directors has considered the possible disadvantages of the Change of Corporate Domicile and binding on all parties.

Interest of the Company’s Directors and Executive Officers in the Change of Corporate Domicile

The Administrator will select participantsshareholders should be aware that certain of our directors and executive officers may have interests in the transaction that are different from, among those key employeesor in addition to, the interests of the shareholders generally. For example, the Change of Corporate Domicile may provide officers and directors of the Corporation with more clarity and consultantscertainty in respect of the indemnification and advisorsadvancement rights available to the Company or its affiliates who,them and, with respect to directors, in the opinionreduction of their potential personal liability in their fiduciary roles for the Corporation. The Board has considered these interests, among other matters, in reaching its decision to recommend that our shareholders vote in favor of this proposal and will continue to consider these interests in deciding whether to exercise its discretion to effect the Change of Corporate Domicile.

Certain U.S. Federal Income Tax Consequences

The following discussion summarizes certain U.S. federal income tax consequences of the Administrator,Change of Corporate Domicile to holders of our common stock that are in“U.S. persons” for U.S. federal income tax purposes and that hold such common stock as a position to make a significant contribution tocapital asset within the successmeaning of the Company and its affiliates; provided, that, subject to such express exceptions, if any, as the Administrator may establish, eligibility may be further limited to those persons as to whom the useSection 1221 of a Form S-8 registration statement is permissible. Currently, there are approximately seventy-seven employees and four non-employee directors of the Company who are eligible to participate in the 2013 Plan. Eligibility for ISOs (as defined below) is limited to employees of the Company or of a “parent corporation” or “subsidiary corporation” of the Company as those terms are defined in Section 424 of the U.S. Internal Revenue Code of 1986, as amended. The discussion is based on applicable law currently in effect, and amended from time to time, or any successor statute in effect (the “

We urge you to consult your own tax advisor regarding your particular circumstances and the U.S. federal income and other federal tax consequences to you of the lawChange of Corporate Domicile, as well as any tax consequences arising under the laws of any state, local, foreign or other tax jurisdiction and the possible effects of changes in this area. Furthermore,U.S. federal or other tax laws. We have not requested a ruling from the discussion below does not address the tax considerationsIRS or an opinion of counsel regarding the receipt and exercise of awards under foreign, state and local tax laws, and such tax laws may not correspond to theU.S. federal income tax treatment described herein. consequences of the Change of Corporate Domicile.

The exact federal income tax treatmentChange of transactions under the 2013 Plan will vary depending upon the specific facts and circumstances involved and participants are advisedCorporate Domicile is intended to consult their personal tax advisors

Board of Directors

The Board of Directors unanimously recommends a vote “FOR” approvalthe change of corporate domicile of the foregoing resolution. Proxies will be so voted unless shareholders specify otherwise in their proxies.

Board Structure

Our business affairs are managed under the direction of our Board, which currently consists of 6 members. The role of our Chairman of the Board is currently composedseparate from our Principal Executive Officer. The Board has determined that this structure continues to be appropriate at this time.

Board Risk Oversight Process

Our Board is responsible for oversight of five directors. our risk management policies and procedures. We are exposed to a number of risks, including financial risks, strategic and operational risks and risks relating to regulatory and legal compliance. The Board will regularly discuss with management our major risk exposures highlighting any new risks that may have arisen since they last met and the steps management has taken to monitor and control such exposures, including the guidelines and policies to govern the process by which risk assessment and risk management are undertaken.

The Board oversees the management of risk exposure and risk mitigation in various areas including: (i) risks relating to our employment policies and executive compensation plans and arrangements; (ii) financial risks and taking appropriate actions to help ensure quality financial reporting and appropriately conservative investment practices; and (iii) risks associated with the independence of the Board and potential conflicts of interest. The Audit Committee reviews policies with respect to risk assessment and risk management and consults with outside resources as appropriate on other matters that could have a significant impact on the Company’s consolidated financial statements. The Audit Committee also reviews policies with respect to financial risk and makes recommendations to the Board. The Board’s administration of its risk oversight function has not affected the Board’s leadership structure.

Director Independence

Consistent with NASDAQNasdaq listing requirements, our Board hasmakes an annual determination of the independence of our directors. This determination is made in conjunction with each annual meeting of shareholders. In connection with the 2021 Annual Meeting of Shareholders, the Board had determined that as of the Record Date,Mr. Johnson, Ms. Douglass,Johnson, Mr. JohnsonRamsay and Mr. Rosen are “independent” within the meaning of NASDAQNasdaq Marketplace Rules 5605(b) and 5605(a)(2). During the year ended December 31, 2016, the Board met or took action by unanimous written consent six times (including regularly scheduled and special meetings), and each director attended at least 75% of the aggregate of: (i) the total number of meetings of the Board held during the period for which he or she has been a director; and (ii) the total number of meetings held by all committeesThere are no family relationships among any of our directors or executive officers.

Board on which he or she served during the periods that he or she served.

Our Board has three standing committees: an audit committee;committee (the “Audit Committee”); a compensation committee;committee (the “Compensation Committee”); and a corporate governance and nominating committee. All committee members have been determined to be independent.(the “Corporate Governance and Nominating Committee”). The committees operate under written charters that are available for viewing on our website at

Audit Committee

It is the responsibility of the Audit Committee to oversee our accounting and financial reporting processes and the audits of our consolidated financial statements. In addition, the Audit Committee assists the Board in its oversight of our compliance with legal and regulatory requirements. The specific duties of the Audit Committee include: monitoring the integrity of our financial process and systems of internal controls regarding finance, accounting and legal compliance; selecting our independent auditor; monitoring the independence and performance of our independent auditor; and providing an avenue of communication among the independent auditor, our management and our Board. The Audit Committee has the authority to conduct any investigation it feels appropriate to fulfill its responsibilities, and it has direct access to all of our employees and to the independent auditor. The Audit Committee also has the ability to retain, at our expense and without further approval of the Board, special legal, accounting or other consultants or experts that it deems necessary in the performance of its duties. TheIn 2020, the Audit Committee met or took action by unanimous written consent four times in 2016. The Audit Committee iswas comprised of three members: Craig Johnson, David Ramsay and Robert Rosen and Laura Douglass. CraigRosen. Mr. Johnson is the chairChairman of the Audit CommitteeCommittee. Messrs. Johnson and Ramsay each qualify as an “audit committee financial expert” as that term is deemed to bedefined under the audit committee's financial expert. As of the Record Date, eachSEC rules and regulations. Each member of the Audit Committee metmeets the requirements for independence under the listing standards of the NASDAQNasdaq Capital

Market and the Securities and Exchange Commissions (the

Report of the Audit Committee

The Audit Committee oversees our financial reporting process. Management has the primary responsibility for the consolidated financial statements and the reporting process, including our system of internal control over financial reporting. In fulfilling its oversight responsibilities, the Audit Committee reviewed and discussed the audited consolidated financial statements in our Annual Report on Form 10-K for the year ended December 31, 2020 with management, including a discussion of the quality, not merely the acceptability, of the accounting and financial reporting principles, the reasonableness of significant judgments and the clarity of disclosures in the financial statements.

The Audit Committee reviewed our audited consolidated financial statements with our independent auditor, which is responsible for expressing an opinion on the conformity of those audited consolidated financial statements with U.S. generally accepted accounting principles, including a discussion of such matters as are required to be discussed under U.S. generally accepted auditing standards. In addition, the Audit Committee has discussed with the independent auditor the matters required to be discussed, and received from them the written disclosures and letter required, by the applicable requirements of the Public Company Accounting Oversight Board and SEC, including with respect to its independence from us and our management. The Audit Committee has also considered the compatibility of the independent auditor’s provision of non-audit services to us with the auditor’s independence.

The Audit Committee discussed with our independent auditor the overall scope and plan for its audit. The Audit Committee met with the independent auditor, with and without management present, to discuss the results of its examinations, its evaluations of our internal controls and the overall quality of our financial reporting.

Based on the reviews and discussions referred to above, the Audit Committee recommended that our audited consolidated financial statements be included in our Annual Report on Form 10-K for the year ended December 31, 2020 for filing with the SEC. This report is provided by the following directors, who perform the functions of the Audit Committee:

Craig Johnson, Chairman of Audit Committee

David Ramsay

Robert Rosen

Compensation Committee

It is the responsibility of the Compensation Committee to assist the Board in discharging the Board’s responsibilities regarding the compensation of our employees, officers and directors. The specific duties of the Compensation Committee include: making recommendations to the Board regarding the corporate goals and objectives relevant to executive compensation; evaluating our executive officers’ performance in light of such goals and objectives; recommending compensation levels to the Board based uponon such evaluations; administering our incentive compensation plans, including our equity-based incentive plans; making recommendations to the Board regarding our overall compensation structure, policies and programs; and reviewing the Company’s compensation disclosures. The Compensation Committee may delegate authority to review and approve the compensation of our employees to certain of our executive officers, including with respect to awards made under our equity incentive plans. Even where the Compensation Committee does not delegate authority, our executive officers will typically make recommendations to the Compensation Committee regarding compensation to be paid to our employees and the size of equity awards under our equity incentive plans. Additional information regarding the processes and procedures of the Compensation Committee is provided below under the caption “Executive Compensation.” The Compensation Committee met or took action by unanimous written consent five times in 2016. The Compensation Committee is comprised of two members: Craig Johnson and Laura Douglass.Johnson. Craig Johnson is the chairChairman of the Compensation Committee. As of the Record Date, eachEach member of

the Compensation Committee metmeets the requirements for independence under the listing standards of the NASDAQNasdaq Capital Market and the SEC rules and regulations.

Nominating and Corporate Governance andCommittee

The primary responsibilities of our Nominating Committee

Meetings of the Board of Directors

During the year ended December 31, 2020, the Board met 10 times (including regularly scheduled and special meetings). During the year ended December 31, 2020, the Audit Committee met six times, the Compensation Committee met two times and the Nominating and Corporate Governance Guidelines

Director Nominations

Our Corporate Governance and Nominating Committee regularlyperiodically assesses the appropriate size of the Board and whether any vacancies on the Board are expected due to retirement or otherwise. In the event that vacancies are anticipated or otherwise arise, the Corporate Governance and Nominating Committee may utilize a variety of methods for identifying and evaluating director candidates. Candidates may come to the attention of the Corporate Governance and Nominating Committee through current directors, professional search firms, shareholders or other persons. Once the Corporate Governance and

In accordance with procedures set forth in the Company’s Bylaws, as amended and restated (the “

recommendations for directors if we receiveshareholders follow the procedures specified in our Bylaws for providing timely written notice, in proper form, of the intent to make a nomination at a meeting of shareholders. To be timely, the notice must be received within the time frame discussed in our Bylaws. To be in proper form, the notice must, among other matters, include each director nominee’s written consent to serve as a director if elected, a description of all arrangements or understandings between the nominating shareholder and each director nominee and information about the nominating shareholder and each director nominee. A copy of our Bylaws will be provided uponon written request to our Secretary.

Shareholder Communications

Our shareholders may communicate with our Board or a particular director by sending a letter addressed to the Board or a particular director to our Secretary at 201 Jones Road, Suite 400, Waltham, Massachusetts 02451. All communications will be compiled by our Secretary and forwarded to the Board, or the director, accordingly. The Secretary opens, logs and forwards all such correspondence (other than advertisements or other solicitations) to the Board, or the director, accordingly, unless a director has requested that the Secretary forward correspondence unopened.

Corporate Secretary.

We have adopted a set of Corporate Governance Guidelines that describe a number of our corporate governance practices. The Corporate Governance Guidelines are available for viewing on our website at Annual Meetings

Anti-hedging Policy

We have a policy that encouragesprohibits our directors, officers, employees and consultants from engaging in short-term speculative transactions in the Company securities, including: (i) short-term trading (defined as selling Company securities within 6 months following a purchase); (ii) short-sales; (iii) transactions involving publicly traded options or other derivatives, such as trades in puts or calls in Company securities; and (iv) hedging transactions.

Code of Business Conduct and Ethics; Corporate Website

We have adopted a Code of Business Conduct and Ethics that applies to attendall of our annual shareholder meeting.directors, officers and employees, including our principal executive officer, principal financial and accounting officer and persons performing similar functions. Our Code of Business Conduct and Ethics is posted on our website at www.ljpc.com in the Corporate Governance section under “Corporate Resources.” We held our 2016 annual shareholder meeting on August 23, 2016, and threeintend to disclose future amendments to certain provisions of the Company’s directors were present in person for such meeting.

Our executive officers, and their respective ages as of July 1, 2017and respective biographies are set forth below, as well as biographies for officers other than Dr. Tidmarsh, whose biography is set forth under Proposal 1.

Name | Age | Position | ||||

Larry Edwards | 50 | |||||

Director, President and Chief Executive Officer | ||||||

Michael Hearne | 58 | |||||

Chief Financial Officer | ||||||

Larry EdwardsDr. Lakhmir “Mink” S. Chawla has been theserved as a director, President and Chief MedicalExecutive Officer since 2020. From 2015 to 2020, he served in various positions at Tetraphase Pharmaceuticals, Inc., most recently serving as Chief Executive Officer. From 2014 to 2015, Mr. Edwards served as Senior Director of Marketing of the Company since July 2015. Dr. ChawlaGram-negative Franchise of Cubist Pharmaceuticals, Inc. (acquired by Merck & Co., Inc.). From 1999 to 2014, he served in various positions at Merck and Co., Inc., most recently serving as Global Marketing Director of Clostridium Difficile and New Infectious Disease Products. Mr. Edwards received a B.S. degree in business and healthcare administration from Ohio University.

Michael Hearne has more than 20 years of medical experience with particular expertise in critical care and nephrology. Dr. Chawla has been an active investigator in the field of critical care nephrology since 2002. Previously, Dr. Chawla was an Associate Professor of Medicine at the George Washington University from 2008 to 2015, where he had dual appointments in the Department of Anesthesiology and Critical Care Medicine and in the Department of Medicine, Division of Renal Diseases and Hypertension. Dr. Chawla was also the Chief of the Division of Intensive Care Medicine at the Washington D.C. Veterans Affairs Medical Center from 2014 to 2015. During his tenure at George Washington, Dr. Chawla was the designer and lead investigator of a pilot study called the ATHOS (Angiotensin II for the Treatment of High Output Shock) trial, which served as the basis for the Company’s ongoing ATHOS 3 clinical study. Dr. Chawla received an M.D. from the New Jersey Medical School.

Summary Compensation Table

The following table provides information for the years ended December 31, 2020 and 2019 concerning the compensation paid or awarded to our principal executive officer and the two other most highly compensated executive officers (the “Named Executive Officers” or “NEOs”):

Name and Principal Position |

| Year |

| Salary |

|

| Option Awards(1) |

|

| Non-Equity Incentive Plan Compensation(2) |

|

| All Other Compensation(3) |

|

| Total |

| |||||

Current Named Executive Officers |

| |||||||||||||||||||||

Larry Edwards(4)(5) |

| 2020 |

| $ | 208,333 |

|

| $ | 2,165,446 |

|

| $ | 247,833 |

|

| $ | 1,338 |

|

| $ | 2,622,950 |

|

Director, President and Chief Executive Officer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Michael Hearne(5)(6) |

| 2020 |

| $ | 78,969 |

|

| $ | 528,359 |

|

| $ | 48,700 |

|

| $ | 1,986 |

|

| $ | 658,014 |

|

Chief Financial Officer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Former Named Executive Officers |

| |||||||||||||||||||||

Dennis Mulroy(5)(7) |

| 2020 |

| $ | 163,941 |

|

| $ | 1,158 |

|

| $ | - |

|

| $ | 250,183 |

|

| $ | 415,282 |

|

Former Chief Financial Officer |

| 2019 |

| $ | 382,000 |

|

| $ | 143,948 |

|

| $ | 76,400 |

|

| $ | 10,739 |

|

| $ | 613,087 |

|

Darryl Wellinghoff(5)(8) |

| 2020 |

| $ | 295,095 |

|

| $ | 14,726 |

|

| $ | 249,508 |

|

| $ | 117,547 |

|

| $ | 676,876 |

|

Former Chief Commercial Officer |

| 2019 |

| $ | 315,439 |

|

| $ | 578,343 |

|

| $ | 63,213 |

|

| $ | 9,719 |

|

| $ | 966,714 |

|

Lakhmir Chawla, M.D.(5)(9) |

| 2020 |

| $ | 357,379 |

|

| $ | 228,321 |

|

| $ | - |

|

| $ | 11,157 |

|

| $ | 596,857 |

|

Former Chief Medical Officer |

| 2019 |

| $ | 458,000 |

|

| $ | 130,333 |

|

| $ | 91,600 |

|

| $ | 10,611 |

|

| $ | 690,544 |

|

(1) | The amounts reported in this column represent the grant-date fair values of stock options granted to each NEO, calculated in accordance with Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 718, Compensation-Stock Compensation. For a discussion of the assumptions used to calculate the value of our stock options, see Note 8 to the consolidated financial statements in our Annual Report on Form 10-K for the year ended December 31, 2020. The grant-date fair values of stock options awarded in 2019 include stock options granted in January 2020 for services rendered in 2019. |

(2) | The amounts reported in this column represent performance-based cash bonuses paid under the Company’s incentive bonus programs earned during the respective year. |

(3) | Unless otherwise indicated, the amounts reported in this column represent the Company’s matching contribution to each NEO’s 401(k) plan account and/or life insurance premiums paid by the Company. |

(5) | Salary was pro-rated based on the portion of the year such officer served as an NEO. |

(6) | Mr. Hearne’s compensation reflects the portion of his time dedicated to the Company. For the year ended December 31, 2020, Mr. Hearne’s option awards include the grant-date fair values of options to purchase 100,000 shares of La Jolla common stock on becoming Chief Financial Officer of the Company in June 2020. |

(7) | Effective May 31, 2020, Mr. Mulroy mutually agreed with the Company to leave as Chief Financial Officer. For the year ended December 31, 2020, all other compensation includes $239,675 for severance and medical coverage paid to Mr. Mulroy in 2020 in connection with his separation. |

(8) | Effective September 30, 2020, Mr. Wellinghoff’s employment as Chief Commercial Officer of the Company was terminated without cause. For the year ended December 31, 2020, all other compensation includes $106,390 for severance and medical coverage paid to Mr. Wellinghoff in 2020 in connection with his separation. The grant-date fair values of stock options granted to Mr. Wellinghoff in 2019 include stock options granted on becoming Chief Commercial Officer of the Company. |

(9) | Effective October 2, 2020, Dr. Chawla resigned as Chief Medical Officer of the Company. |

Outstanding Equity Awards as of December 31, 2020

The following table presents information regarding the Chief Operating Officer since January 2017. Prior to her appointment as Chief Operating Officer, Ms. Carveroutstanding option awards held a number of operational roles of increasing responsibility since joining the Company in February 2014, most recently as Senior Vice President, Operationsby each of the Company. Ms. Carver has more than 20 yearsNEOs as of cross-functional leadership experience in pharmaceutical drug development and the healthcare industry. Prior to joining La Jolla, Ms. Carver was Senior Director of Project Management at Spectrum Pharmaceuticals, Inc., leading the NDA and launch activities for Beleodaq®, an FDA-approved, anti-cancer agent, from 2012 to 2014. Previously, she held various roles at Allos Therapeutics, Inc. from 2001 to 2012, including Project Manager for Folotyn®, an FDA-approved, anti-cancer agent, and led integration activities following the acquisition of Allos by Spectrum Pharmaceuticals in 2012. Ms. Carver received a B.S.N. and M.B.A. from the University of Colorado.December 31, 2020:

| Option Awards | ||||||||||||||||

Name |

| Vesting Commencement Date |

| Number of Securities Underlying Unexercised Options (#) Exercisable |

|

| Number of Securities Underlying Unexercised Options (#) Unexercisable |

|

|

| Option Exercise Price ($) |

|

| Option Expiration Date(1) | |||

Current Named Executive Officers | |||||||||||||||||

Larry Edwards |

| 7/29/2020 |

|

| - |

|

|

| 300,000 |

| (2) |

| $ | 4.03 |

|

| 7/29/2030 |

|

| 7/29/2020 |

|

| - |

|

|

| 100,000 |

| (3) |

| $ | 4.03 |

|

| 7/29/2030 |

|

| 12/10/2020 |

|

| - |

|

|

| 278,350 |

| (2) |

| $ | 4.53 |

|

| 12/10/2030 |

Michael Hearne |

| 6/1/2020 |

|

| - |

|

|

| 100,000 |

| (2) |

| $ | 4.55 |

|

| 6/1/2030 |

|

| 10/15/2020 |

|

| - |

|

|

| 169 |

| (2) |

| $ | 3.91 |

|

| 10/15/2030 |

|

| 10/30/2020 |

|

| - |

|

|

| 196 |

| (2) |

| $ | 3.40 |

|

| 10/30/2030 |

|

| 11/13/2020 |

|

| - |

|

|

| 141 |

| (2) |

| $ | 4.68 |

|

| 11/13/2030 |

|

| 11/30/2020 |

|

| - |

|

|

| 134 |

| (2) |

| $ | 4.97 |

|

| 11/30/2030 |

|

| 12/10/2020 |

|

| - |

|

|

| 52,191 |

| (2) |

| $ | 4.53 |

|

| 12/10/2030 |

|

| 12/15/2020 |

|

| - |

|

|

| 147 |

| (2) |

| $ | 4.50 |

|

| 12/15/2030 |

|

| 12/31/2020 |

|

| - |

|

|

| 1,648 |

| (2) |

| $ | 3.88 |

|

| 12/31/2030 |